Clyde Hill, WA October 2025 Housing Market

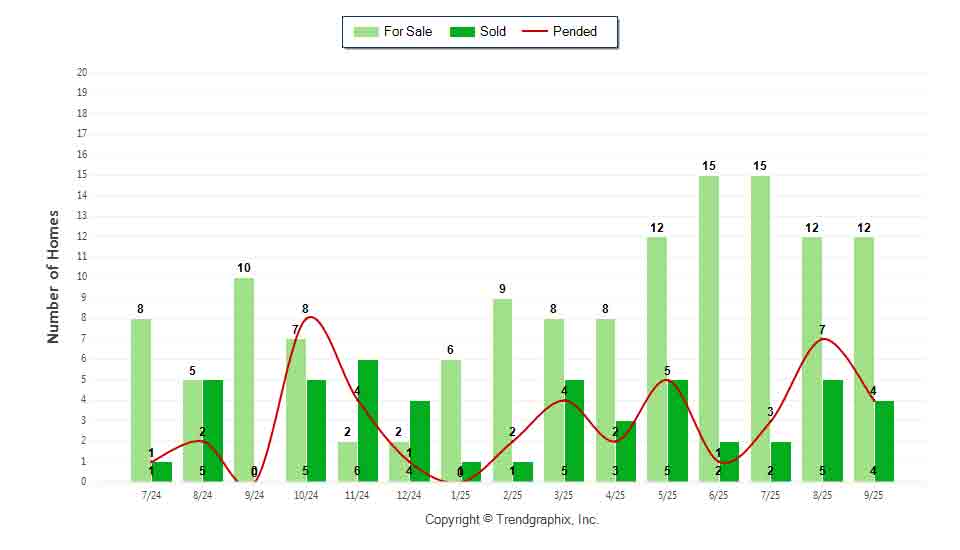

September 2025 was a Neutral market! The number of for sale listings was up 20% from one year earlier and the same as the previous month. The number of sold listings was 4 and decreased 20% month over month. The number of under contract listings was down 42.9% compared to previous month. The Months of Inventory based on Closed Sales was 3, down 70% from the previous year.

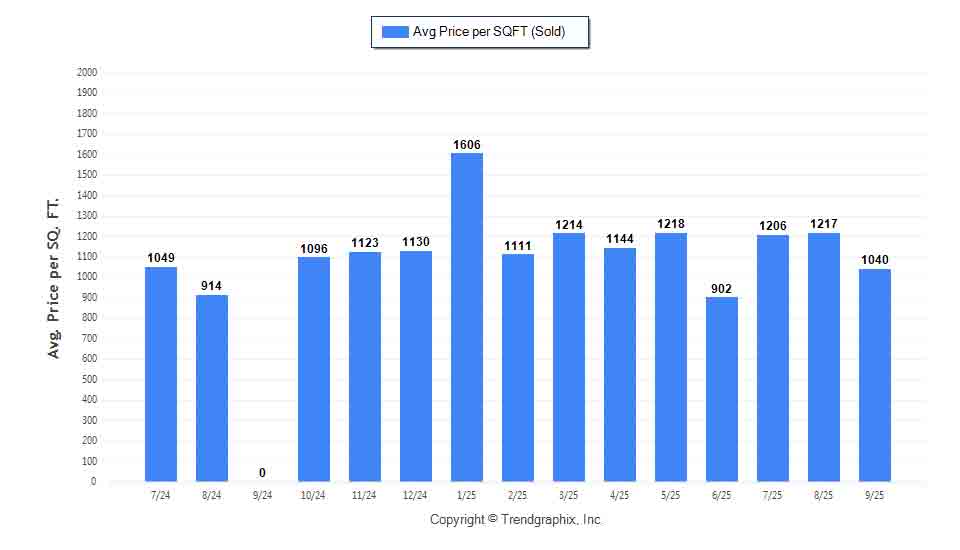

The Average Sold Price per Square Footage was down 14.5% compared to previous month. The Median Sold Price decreased by 17.5% from last month. The Average Sold Price also decreased by 23.2% from last month. Based on the 6 month trend, the Average Sold Price trend was "Neutral" and the Median Sold Price trend was "Neutral".

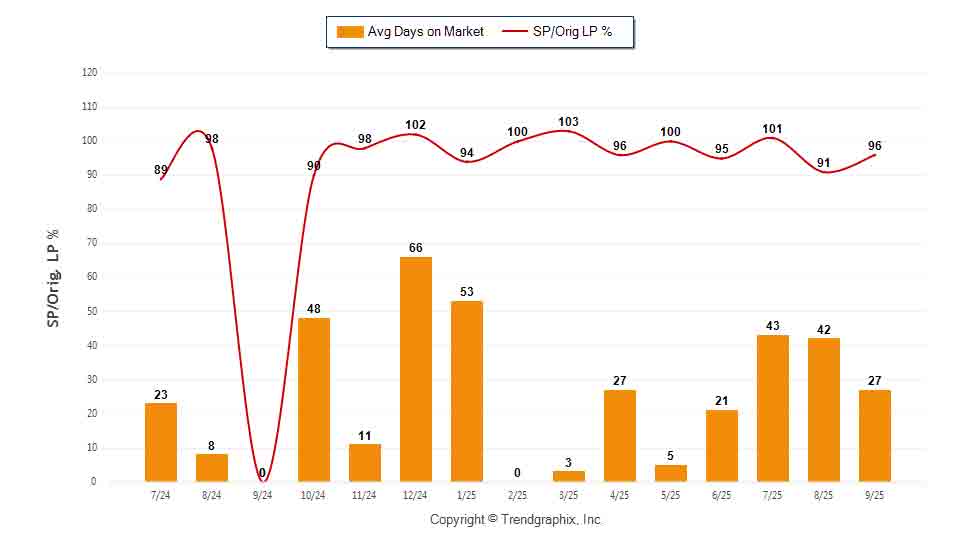

The Average Days on Market showed a neutral trend. The ratio of Sold Price vs. Original List Price was 96%.

Video edited on Kapwing

It was a Neutral Market

Property Sales (Sold)

September property sales were 4, the same as in September of 202420% lower than the 5 sales last month.

Current Inventory (For Sale)

Versus last year, the total number of properties available this month was higher by 2 units of 20%. This year's bigger inventory means that buyers who waited to buy may have bigger selection to choose from. The number of current inventory was the same as the previous month.

Property Under Contract (Pended)

There was a decrease of 42.9% in the pended properties in September, with 4 properties versus 7 last month. This month's pended property sales were the same as at this time last year.

All reports are published October 2025, based on data available at the end of September 2025, except for the today’s stats. Information and statistics derived from Northwest Multiple Listing Service. Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

The Average Sold Price per Square Footage was Neutral*

The Average Sold Price per Square Footage is a great indicator for the direction of property values. Since Median Sold Price and Average Sold Price can be impacted by the 'mix' of high or low end properties in the market, the Average Sold Price per Square Footage is a more normalized indicator on the direction of property values. The September 2025 Average Sold Price per Square Footage of $1,040 was down 14.5% from $1,217 last month.

* Based on 6 month trend – Appreciating/Depreciating/Neutral

The Days on Market Showed Neutral Trend*

The average Days on Market (DOM) shows how many days the average property is on the market before it sells. An upward trend in DOM trends to indicate a move towards more of a Buyer’s market, a downward trend indicates a move towards more of a Seller’s market. The DOM for September 2025 was 27, down 35.7% from 42 days last month.

The Sold/Original List Price Ratio Remains Steady**

The Sold Price vs. Original List Price reveals the average amount that sellers are agreeing to come down from their original list price. The lower the ratio is below 100% the more of a Buyer’s market exists, a ratio at or above 100% indicates more of a Seller’s market. This month Sold Price vs. Original List Price of 96% was up 5.5% % from last month.

* Based on 6 month trend – Upward/Downward/Neutral

** Based on 6 month trend – Rising/Falling/Remains Steady

All reports are published October 2025, based on data available at the end of September 2025, except for the today’s stats. Information and statistics derived from Northwest Multiple Listing Service. Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

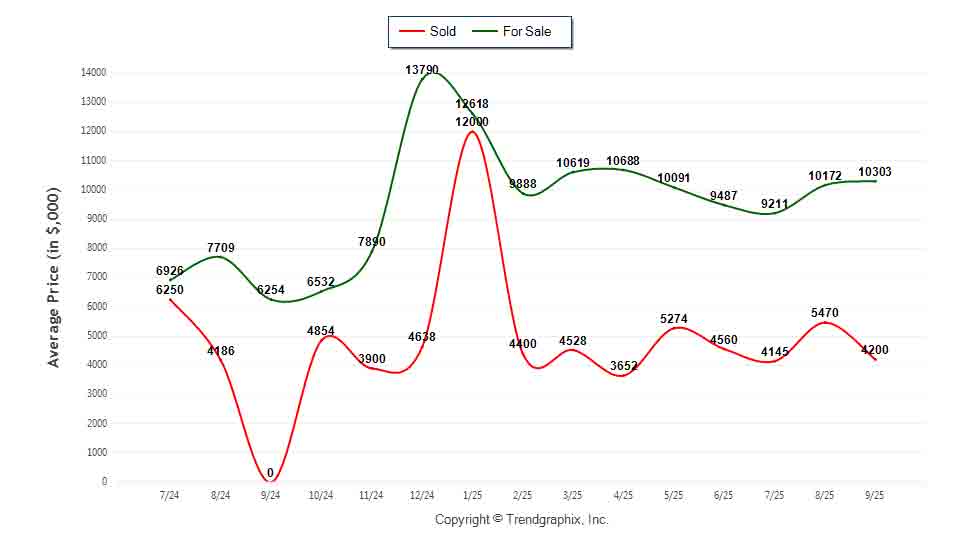

The Average For Sale Price was Neutral*

The Average For Sale Price in September was $10,303,000, up 64.7% from $6,254,000 in September of 2024 and up 1.3% from $10,172,000 last month.

The Average Sold Price was Neutral*

The Average Sold Price in September was $4,200,000, down 23.2% from $5,470,000 last month.

The Median Sold Price was Neutral*

The Median Sold Price in September was $4,000,000, down 17.5% from $4,850,000 last month.

* Based on 6 month trend – Appreciating/Depreciating/Neutral

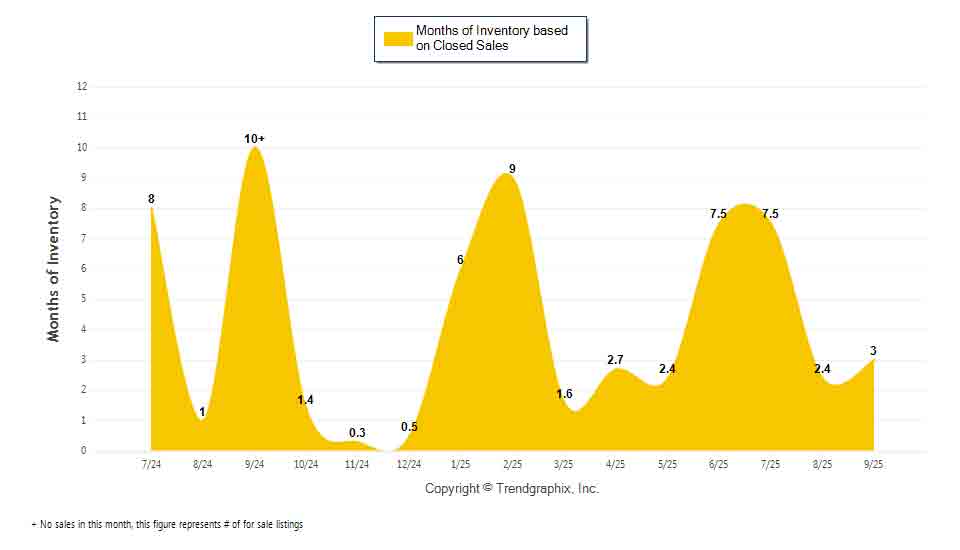

It was a Neutral Market*

A comparatively lower Months of Inventory is more beneficial for sellers while a higher months of inventory is better for buyers.

*Buyer’s market: more than 6 months of inventory

Seller’s market: less than 3 months of inventory

Neutral market: 3 – 6 months of inventory

Months of Inventory based on Closed Sales

The September 2025 Months of Inventory based on Closed Sales of 3 was decreased by 70% compared to last year and up 25% compared to last month. September 2025 was Neutral market.

Months of Inventory based on Pended Sales

The September 2025 Months of Inventory based on Pended Sales of 3 was decreased by 70% compared to last year and up 75.8% compared to last month. September 2025 was Neutral market.

All reports are published October 2025, based on data available at the end of September 2025, except for the today’s stats. Information and statistics derived from Northwest Multiple Listing Service. Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

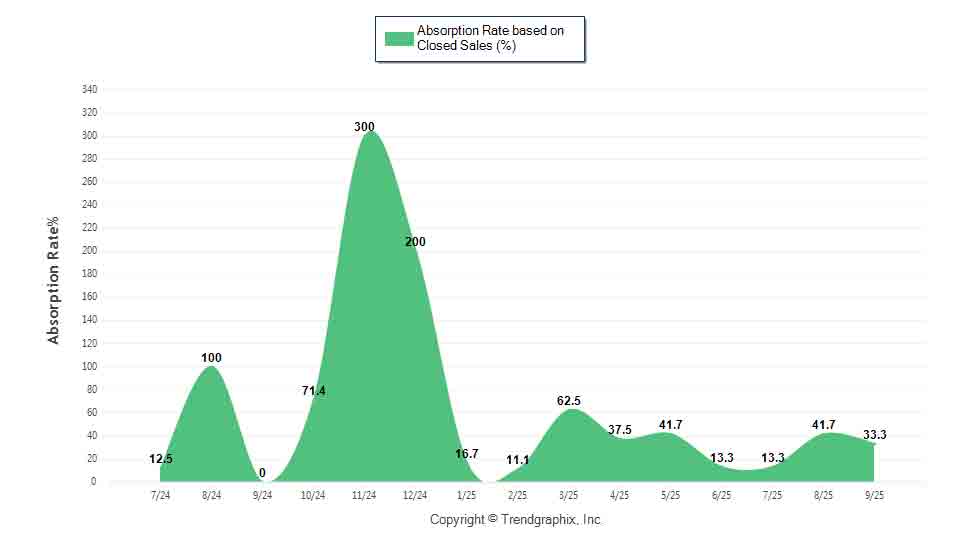

It was a Seller's Market*

Absorption Rate measures the inverse of Months of Inventory and represents how much of the current active listings (as a percentage) are being absorbed each month.

*Buyer’s market: 16.67% and below

Seller’s market: 33.33% and above

Neutral market: 16.67% - 33.33%

Absorption Rate based on Closed Sales

The September 2025 Absorption Rate based on Closed Sales of 33.3 was down 20.2% compared to last month.

Absorption Rate based on Pended Sales

The September 2025 Absorption Rate based on Pended Sales of 33.3 was down 42.9% compared to last month.

All reports are published October 2025, based on data available at the end of September 2025, except for the today’s stats. Information and statistics derived from Northwest Multiple Listing Service. Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

©Copyright 1998-2025. All Rights Reserved